ASX retreats from record as markets await Fed chair speech — as it happened

After crossing 9,000 points for the first time, the ASX 200 has dipped in early trade, following a retreat on Wall Street.

Traders are bracing for an address by Federal Reserve chair Jerome Powell to the Jackson Hole central bank symposium on Friday, US time.

Look back on how the trading day unfolded, plus major business news and analysis from our specialist reporters, on the markets blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

Live updates

Market snapshot

- ASX 200: -0.6% to 8,967 points

- Australian dollar: flat at 64.20 US cents

- Nikkei 225: -0.1% to 42,591 points

- Shanghai Comp: +1% to 3,809 points

- Hang Seng: +0.4% to 25,217 points

- S&P 500: -0.4% to 6,370 points

- Nasdaq: -0.3% to 21,100 points

- FTSE: +0.2% to 9,309 points

- EuroStoxx: flat at 559 points

- Spot gold: -0.3% at $US3,327/ounce

- Brent crude: +0.1% to $US67.75/barrel

- Iron ore: -0.1% to $US101.35/tonne

- Bitcoin: +0.7% to $US113,244

Price current around 4:30pm AEST

Live updates on the major ASX indices:

Thanks for joining us

That'll be all from us today!

And remember, you can catch a wrap of the week that was with Close of Business on ABC News Channel tonight at 9:30pm AEST, or anytime on ABC iView.

You all have a lovely weekend! See you next week!

LoadingStock swings and market caution ahead of Powell

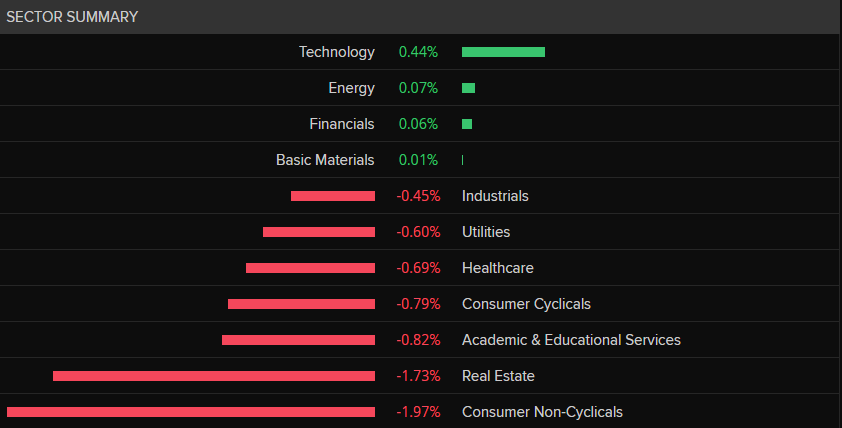

Taking a look at some of the detail behind the ASX 200 0.6% fall — overall, we had 71 stocks gaining, 11 unchanged and 118 stocks in the red.

When looking at the sectors, Technology at the top, gaining 0.2%, followed by Energy up 0.2% and then Financials, just up 0.04%.

Academic & Educational Services finished at the bottom losing 3.9% (thanks to the fall in one stock, IDP Education), followed by Consumer Non-Cyclicals, down 2%, and then Healthcare, down 1.9%.

Among companies, the top mover was Zip Co, up 20.2%, followed by Codan, up 8.2%.

It wasn't a good day for Inghams Group, down 20.2%, followed by Guzman Y Gomez, down 18.2%.

Now let's turn to the big news coming up overnight — US Federal Reserve chair Jerome Powell's speech at the Jackson Hole gathering of central bankers.

Here's some analysis from Swissquote senior analyst Ipek Ozkardeskaya:

"While he may stick to a "data dependent" message, the venue has historically hosted major policy shifts.

"Markets are alert to any surprise, and there is a greater chance that we will see a hawkish surprise than the contrary.

"A cautiously hawkish tone from Powell could further unwind the market's extra-dovish positioning.

"That could mean a rebound in US 2-year yields, pressure on the S&P 500, a stalling of the small-cap rally, and renewed strength in the US dollar.

"Rising global yields… add to the risk of a broader sell-off if Powell strikes a firmer line."

So stay tuned for the latest over the weekend and we'll have all the wash up on Monday. Until then, you can catch up on today's developments below, or download the ABC News app and subscribe to our range of news alerts for the latest news.

ASX ends Friday session in the red

The ASX 200 lost 0.6% on Friday, retreating back below 9,000 points after posting a fresh record yesterday.

It was still a positive week, however, with the benchmark index adding 0.9% over the past five sessions.

That's its third straight weekly gain.

CBA home loan conditional pre-approvals on the rise

New Commonwealth Bank data has shown home loan conditional pre-approval applications jumped 12% this year compared to the same period in 2024, following the second variable rate cut of the year in May.

New South Wales led the charge with a 25% increase, followed by Queensland at 16%, while Victoria held steady.

Executive General Manager Home Buying Marcos Meneguzzi said it was encouraging to see more people feeling confident about their home-buying options.

"The Aussie dream has long been anchored in home ownership, and this rise in conditional pre-approval activity reflects a renewed sense of optimism as borrowers respond to lower interest rates and increased borrowing power.

“Conditional pre-approval is one of the very first steps when buying a home.

"Buyers get a sense of their budget and that helps them act quickly when the right property comes along."

The average amount home seekers applied to borrow was just over $733,000, 13% higher than the same time last year, according to the CommBank data.

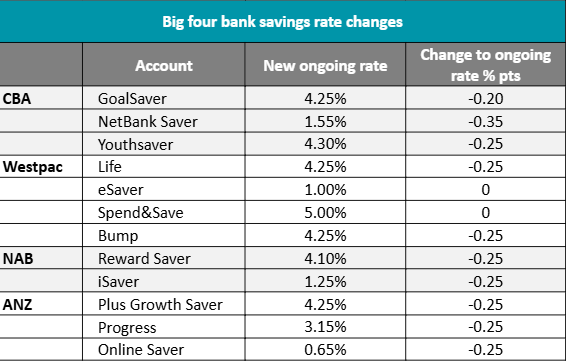

CBA, Westpac, ANZ cut savings rates

Three of the country's biggest banks - CBA, Westpac and ANZ - have announced they will lower the savings rates of millions of Australians' accounts, following last week’s RBA cash rate cut.

NAB already made its savings cuts last Friday.

Here are the key takeaways:

- CBA: GoalSaver customers escaped the full cut, with the maximum ongoing rate dropping by 0.2 to 4.25%. CBA’s NetBank Saver’s ongoing rate plunged 0.35 to a paltry 1.55%, while Youthsaver fell 0.25 to 4.3%.

- Westpac: Westpac’s Life account dropped 0.25 to 4.25%. eSaver’s existing customer rate remained unchanged at 1%. Spend&Save for young adults held steady at 5%.

- NAB: Reward Saver and iSaver both dropped by 0.25. The new ongoing rates are 4.1% and 1.25% respectively.

- ANZ: All savings rates fell by 0.25, leaving the bank’s highest rate at 4.25% and its lowest ongoing rate at 0.65%.

Canstar's rate tracking has shown 26 banks have cut savings rates, with the average cut to ongoing rates since 12 August being 0.23%.

5.00% will be the highest ongoing savings rate in the database, according to Canstar.

Inghams expects to win chickenfeed tax case

I know we get to cover a lot, but this is one of the oddest I've done.

Mega poultry producer has been caught in a six-year battle with the ATO about $50 million it has claimed in research and development credits.

The ABC understands the dispute is about what the chickens are fed, and whether it is innovative enough to earn 6 x $8.5 million in incentives from 2019 onwards.

There's more detail in my article.

Today, in its annual report, Inghams says it expects to win - and get the taxpayer cash.

"Based on information available, Inghams does not consider it probable that the company’s income tax assessment will be amended in relation to this matter and no uncertain tax provision was recognised as at 29 June 2024."

Confident? They haven't left aside money to pay it back, so yep.

Developer says government "doesn't want to hear it" on forces pushing away investment

More from the ever-fascinating Australian Property Developers Association event, particularly from Salta Properties managing director, Sam Tarascio, who is also the Victorian President of the Property Council of Australia.

Salta was founded in 1970 by Sam's father, Salvatore "Sam" Tarascio — who was present at the event and inducted as a "legend" of the industry.

Salta's impact is everywhere in the southern capital, most notably in the once super-grim north-east corner of Richmond.

(I can say that - I lived there!)

The area of what was low-rise warehouses and corporate offices is now home to thousands of people on the banks of the Yarra River, largely through that developer.

Anyway, Sam (junior) is not a fan of the Victorian government, particularly the taxes it has imposed on developers and construction, and policies like cementing work from home, which was discussed on the blog earlier today.

"We've got the leading attributes to be the leading city in Australia. We should be a property powerhouse.

"We've got the natural advantages. We've got the unnatural barrier … the disadvantages of taxation (not aligning) with NSW.

"The biggest problem we have is our settings not aligning."

Mr Tarascio says he spends about a third of his time advocating on behalf of the industry (to the government) and to "get capital into Victoria".

But he's not seeing movement on things like the work from home (WFH) decision — which has the potential impact of scaring away investment.

"I tell it to the government. But they don’t want to hear it."

'What if we have it all backwards?' The case for lower rates to help boost productivity

Westpac's chief economist, Luci Ellis, generally puts out a Friday note, which is usually very thought-provoking and well worth a read. Today's is no exception.

"Traditionally, economic theory has assumed that monetary policy is 'neutral' in the long run. That is, it can affect inflation, and short-run fluctuations in growth and the labour market, but it has no implications for growth or unemployment in the long run," she observes.

"In Australia, the standard discourse also assumes that productivity growth is more or less fixed, or else determined by government policy. And until recently, it was assumed in many quarters that weak productivity growth meant that demand had to be constrained — by monetary and other policies — to match the weak growth in supply.

"What if we have it all backwards? A growing body of research suggests that tight monetary policy can, in fact, reduce long-run growth. One way this might happen is that by slowing demand, tight monetary policy reduces the incentive to invest, and thus the future capital stock and future productivity. This is on top of the 'scarring' effects on workers that we normally think of as long-run effects of recessions."

Fortunately, according to the former RBA assistant governor, the Reserve Bank seems to have extricated itself from that way of thinking.

"We can see, then, why an extended period of weak demand is so toxic: by discouraging current investment or shifts of capital into the most productive uses, it reduces the capacity to meet future demand," Dr Ellis continues.

"The fires of recession (and plain old soggy growth) are not cleansing — they are just destructive. Unfortunately, the same literature generally finds that loose monetary policy does not directly add to capacity in the long run, though a short-run boost to productivity from reallocation is implied by some models.

"This is why the RBA's pivot to no longer believing that weak productivity growth requires it to tamp down demand is so consequential — and so welcome. That change of heart avoids what could have become a significant policy error."

The coming months will tell just how much RBA views on productivity and its relationship with the appropriate level of interest rates have changed.

AUSTRAC orders audit of global crypto exchange

Financing regulator Australian Transaction Reports and Analysis Centre (AUSTRAC) has directed Binance Australia to appoint an external auditor after identifying serious concerns with the crypto exchange’s anti-money laundering and counter terrorism financing (AML/CTF) controls.

Established in 2017, Investbybit — Binance Global's Australian arm — is the world's largest centralised crypto exchange by transaction volume.

AUSTRAC CEO, Brendan Thomas, said AUSTRAC’s National Risk Assessment 2024 highlighted the increasing vulnerability of digital currencies to criminal abuse and the action against Binance followed regulatory engagement across the priority sector.

“AUSTRAC is committed to working with industry to ensure strong safeguards are in place to make it harder for criminals to move and conceal illicit funds using digital currencies,” the CEO said.

“Big global operators may appear well-resourced and positioned to meet complex regulatory requirements, but if they don’t understand local money laundering and terrorism financing risks, they are failing to meet their AML/CTF obligations in Australia.

Mr Thomas said businesses' systems must adapt to the regulatory requirements, not the other way around.

“Understanding specific risks of criminality in the Australian context is crucial to ensure they’re meeting their reporting obligations here.”

Concerns were prompted by several issues, including Binance’s latest independent review, which was limited in scope relative to its size, business offerings and risks, according to AUSTRAC.

The watchdog has also flagged concerns with high staff turnover at Binance and a lack of local resourcing and senior management oversight, raising questions about the adequacy of its AML/CTF governance.

Mr Thomas said AUSTRAC expects tighter controls from major global operators, particularly in high-risk sectors involved in large transaction volumes.

"We expect robust customer identification, due diligence and effective transaction monitoring.

“I remind all digital currency exchanges to remain alert to transactions that indicate suspicious behaviour, including money laundering via scams and cybercrime and terrorism financing — the potential for these activities are much higher for global exchanges."

Binance has 28 days to nominate external auditors.

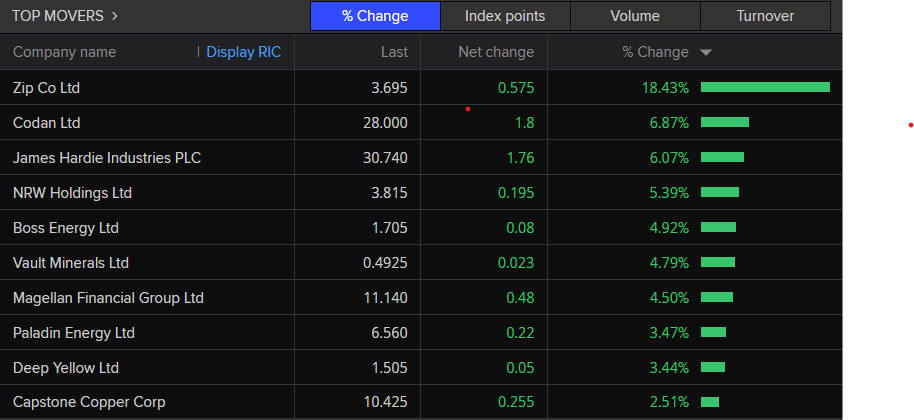

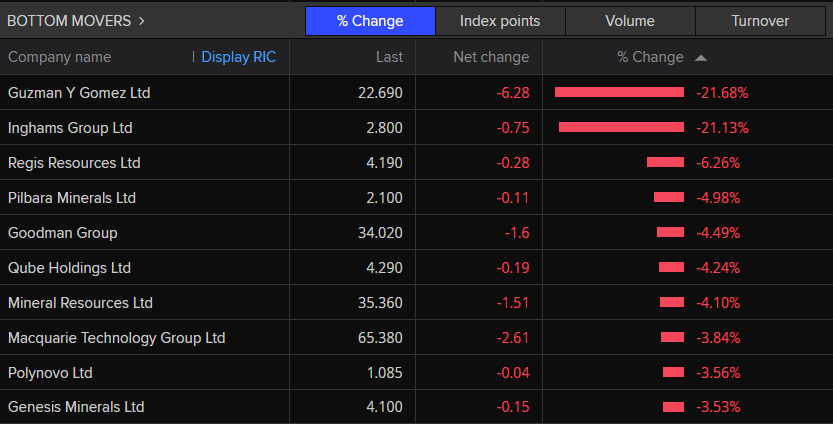

ASX 200 best and worst performers so far

Among the top movers on the ASX 200 were Codan (up $1.80, +6.87%, to $28), James Hardie Industries (up $1.76, +6.07%, to $30.74), and Zip Co (up $0.575, +18.43%, to $3.695).

Among the worst performers were Guzman Y Gomez (down $6.28, -21.68%, to $22.69), Inghams Group (down 75 cents, -21.13%, to $2.80), and Regis Resources (down 28 cents, -6.26%, to $4.19).

And, last but not least, here's the sector summary for today, with the technology sector on top and consumer non-cyclicals at the bottom.

French diary giant to take over New Zealand diary giant's operations

French giant Lactalis will become the largest dairy company in Australia with the purchase of Fonterra Cooperative Group for $3.4 billion.

Fonterra has agreed to the sale of its global business to Lactalis, including its operations in Australia, Oceania, Sri Lanka and the Middle East.

The cooperative owns well-known brands Western Star butter, Perfect Italiano and Mainland cheeses.

The deal will still need to clear a range of regulatory and shareholder approvals.

You can read more about it from the ABC's Rural team.

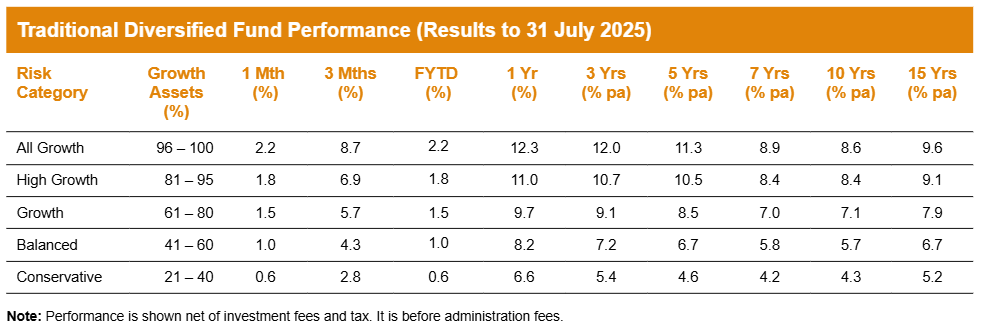

Super funds off to strong start in FY26

Super funds have kicked off the new financial year in strong fashion, with the median growth fund up 1.5% in July, after delivering a stellar 10.4% return for the 2024/25 financial year.

With share markets also up in August so far, superannuation consultant Chant West estimates the median growth fund is already up 2.7% over the first seven weeks of the new financial year.

Head of super investment research Mano Mohankumar said share markets globally were up in July, as markets reacted positively to progress on trade negotiations between the US and several of its major trading partners ahead of the August 1 deadline.

“During the month, the House of Representatives passed the One Big Beautiful Bill Act (US President Trump’s core tax and spending policies), which reduced some policy uncertainty.

"Healthy US corporate earnings results, particularly from most of the mega-cap technology companies, also supported share markets."

Mr Mohankumar noted that markets largely looked through the ongoing conflict in Ukraine and the Middle East, while geopolitical risks remained.

The table below compares the median performance to the end of July 2025 for each of the traditional diversified risk categories in Chant West’s Super Fund Performance Survey.

“International equities performance over the past financial year has been very strong, outpacing even the S&P 500 for the same period,” said David Gallagher, executive director of research at Rainmaker Information.

“Many factors have contributed to this outcome including economic and policy factors, fiscal stimulus in Europe, improved investor sentiment, investors pivoting toward diversification amid US headwinds, as well as attractive valuations relative to the US," Mr Gallagher said.

Medians for multi-asset diversified products in different sectors were higher than in May, with 12.1% for growth, 10.8% for balanced, and 8.0% for capital stable, Rainmaker Information said.

Credit products recorded a median return of 7.4% over the 12-month period.

WFH policy part of 'sovereign risk' for Victorian construction investment, conference hears

The immutable requirements of politics (get re-elected) and the fluid nature of capital are colliding in Melbourne.

A recently announced policy from the dominant Labor government will cement the right of Victorian workers to work from home

Sparking a fight with employers was merely the first part, but the policy, which will enshrine work from home under state law before next year's state election, is making waves elsewhere.

The policy is contentious, not just for its impact or for the fact the federal government makes laws about industrial relations, meaning they will likely be challenged in court. (There's more detail in the article below).

But they're already being challenged by investors.

At yesterday's Australia Property Developers Association meeting, Josh Rutman, the executive director, head of capital markets — Victoria of real estate giant JLL (previously Jones Lang LaSalle), said investors in Malaysia and Singapore had raised the development as a key issue, alluding to it creating a situation of "sovereign risk".

Sovereign risk generally relates to governments defaulting on debts … or the head of the armed forces walking into a mine site and telling the CEO that the army runs it now. Not so much in policies that change office vacancy patterns.

Please note that Mr Rutman's presentation had the phrase in quotations ("like this") so it's not his view, just reporting back what investors are telling him about their reduced desire to invest in commercial real estate in Melbourne, when their capital can just as easily fund projects in Osaka or Sydney.

Here's where it hits the politics

Investors are going to hate this quandary, but two things are happening at the same time.

Melbourne continues to enjoy substantial population growth, even as the infrastructure to deal with it, such as train and freeway tunnels, inch towards opening.

And the WFH policy is so popular it might cement a fourth term for the Labor government at the November 2026 election.

In The Age, Chip Le Grand reports that a Resolve Political Monitor survey conducted for the paper "shows primary support for the Labor Party in Victoria rose from a critical low of 22 per cent at the start of the year to 32 per cent recorded over twin surveys in July and August.

"The trajectory of Labor’s recovery mirrors its previous collapse and returns the state government to a strong position from which to enter an election year.

"It leaves the state Liberal Party teetering towards its seventh defeat from eight elections."

A year is a long time in politics, but the Victorian Liberal Party does have a knack for failing to win state elections.

If you're not from here, it's hard to unwind the strands of even recent years, which include allegations of tacitly supporting neo-Nazis, leading to a successful defamation suit, leading to the potential bankruptcy of the leader. And that's before we get to the infighting between moderates and conservatives.

There are 88 seats in the lower house of the Victorian parliament. The Labor Party has 56, the Liberal Party 19.

The Nationals have nine, bringing the Coalition to 28 seats.

Which is half of 56.

So WFH is likely here to stay.

Are traders 'bracing' for Powell speech?

Your introduction to this blog says “Traders are bracing for an address by Federal Reserve chair Jerome Powell”. The use of the word “bracing” indicates they are expecting something unpleasant. Is that the case?

- Jonathan

Hi Jonathan,

You ask a good question.

Probably the best answer is that, from the analysis I've seen, there is more potential for downside than upside from Powell's speech.

Traders are already pricing in a very high (75%) chance that the Fed cuts rates next month, and similar odds that there will be at least one more cut after that before the end of the year.

At best, Powell can offer more certainty that rate cuts are coming, but that's what most traders already expect.

At worst, he could throw cold water on the idea of a rate cut this month and potentially any this year, which would probably send equities down quite sharply.

So, the term bracing is probably fairly apt because most traders seem nervous ahead of his speech, given already stretched share valuations relative to current earnings.

Latitude reports profit surge in first half

Credit card and lending firm Latitude Group has reported profit growth in the first half of 2025, with statutory net profit after tax (NPAT) of $39.2 million, a big jump from the same time a year ago.

The company said its cash NPAT went up by 69% to $46.2 million.

The board has also announced an unfranked interim dividend of 4 cents per share.

Managing director and CEO Bob Belan told the market the result was "another positive step forward", as the financial group simplifies its business.

"Spend and lending volumes across our Pay and Money divisions reached $4.2 billion, a 12% increase compared to last year."

The company attributed the increase to a lift in total purchases on its cards, helped by a David Jones store card partnership launched last year, as well as record high originations for personal and auto loans.

Receivables, or money owed by customers, rose to $7 billion, a five-year high.

Latitude also highlighted partnerships with brands including Adairs and Webjet.

The stock dropped after the result, down 0.7% at 12:35pm AEST.

Monash IVF shares dive 10%

Shares in Monash IVF have dropped 10% after the company reported a fall in underlying profit and released guidance for the year ahead.

The stock is now down more than 40% since January, but off its low point in June, in the wake of a second major embryo error.

RBC Capital Markets analyst Craig Wong-Pan noted the result was in line with the company's recently downgraded guidance, but said it looked to have lost market share in the second half of the year.

It follows two separate incidents with incorrect embryo transfers in Brisbane and Melbourne.

In its results announcement, Monash said its stimulated cycles in Australia dropped 5% over the financial year, compared to a 1.7% drop across the industry.

Meanwhile, international cycles dropped 6.4%, "largely due to macro conditions".

The company expects underlying net profit to come in between $20-23 million for the 2026 financial year, and intends to resume dividends in that period if it hits its forecasts.

"While we expect FY26 to be impacted by continued industry weakness and potential impact from the incidents, we are confident about Monash IVF's growth prospects beyond FY26," acting CEO Malik Jainudeen said.

🎥Do we expect to spend more on Bega cheese soon?

Bega Cheese has seen its share price fall by 1.87% today as of 11:30am AEST, despite being one of the top five best performers in the market on Thursday.

The company's chief executive, Peter Findlay, has joined Alicia Barry to explain why the company increased the dividend and whether consumers are facing higher cheese prices anytime soon.

Loading...Ultra Violette pulls popular product off shelf

Sunscreen brand Ultra Violette has announced it will voluntarily withdraw one of its popular products after testing revealed it couldn't guarantee the SPF 50+ on the label.

Here's what the company said:

"Given this pattern of inconsistency in testing, we have decided to withdraw Lean/Velvet Screen from the market, effective immediately.

"Purchases of this product will be eligible for a refund and a product voucher, regardless of where it was purchased."

Stay across the details from national health equity reporter Rachel Carbonell and investigative reporter Ninah Kopel:

Road user charges just a matter of time as Treasurer to meet with state counterparts

The other main takeaway from Rachel Mealey's AM interview with Treasurer Jim Chalmers was that we can expect to see road user charges soon, to make up for the fall in fuel excise as more drivers go electric.

Rachel asked the Treasurer:

"In what time frame could an owner of an EV expect to start paying a road user charge, and how much do you think they'll pay every year?"

His response:

"It depends on the model that we settle on and the timing of that model.

"I've got an important meeting with the state and territory treasurers in a couple of weeks' time. And they will provide us an options paper to work through.

"There was a surprising degree of consensus around the need for road user charging when it comes to EVs. But there's not yet a perfect consensus on the best model or on the best timing of that, and so I committed to work with the states and territories on that.

"Obviously, at the end of the day a matter for our cabinet. I work closely with colleagues like Catherine King and Chris Bowen and the Prime Minister and others on that, and so we haven't come to a concluded view on the model or the timing of that model. But the direction of travel is pretty clear."

Jim Chalmers is set to meet with his state counterparts to discuss the topic on September 5.

Watch this space.