Woolworths shares plunge as supermarket earnings disappoint, ASX makes modest gain — as it happened

The Australian share market has risen while individual stocks, including Domino's Pizza, Flight Centre, Tabcorp and Woolworths, have made major moves, with the supermarket giant's shares plunging on its result.

Consumer prices rose 2.8 per cent over the year to July, up from 1.9 per cent the prior month and a typical economist forecast of a rise to 2.3 per cent, according to ABS's latest monthly Consumer Price Index (CPI) Indicator.

Look back at how the trading day unfolded on our blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

Live updates

Market snapshot

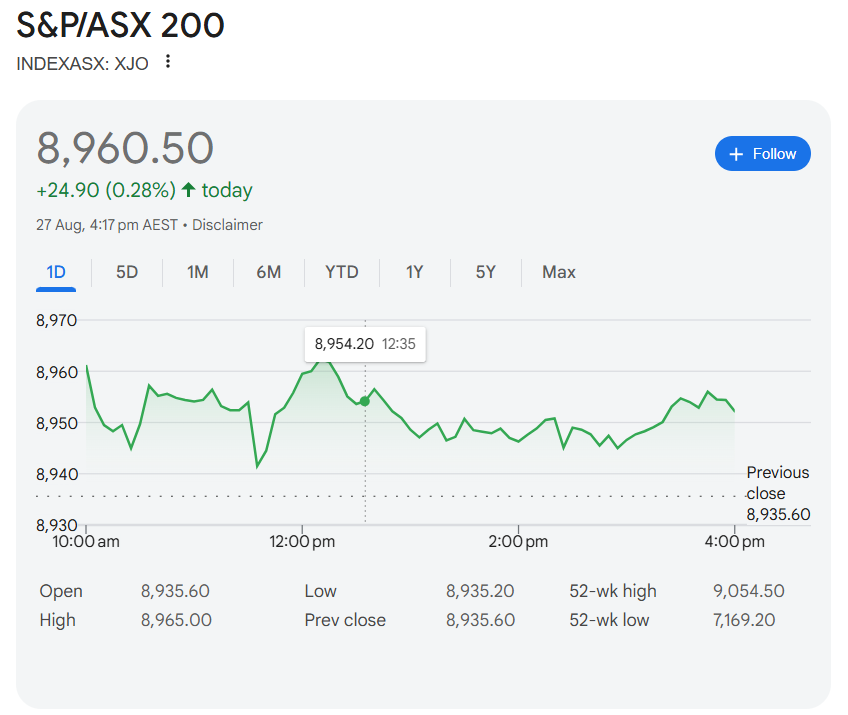

- ASX 200: +0.3% to 8,960 points

- Australian dollar: -0.09% at 64.86 US cents

- Nikkei 225: +0.3% to 42,520 points

- Dow Jones:+0.3% to 45,418 points

- S&P 500: +0.4% to 6,465 points

- FTSE: -0.6% to 9,268 points

- Spot gold: flat at $US3,392/ounce

- Brent crude: -0.16% to $US67.10/barrel

- Iron ore: +0.1% to $US101.75/tonne

- Bitcoin: -0.26% to $US111,092

Prices current around 4:53pm AEST

Live updates from the major ASX indices:

Goodbye

That's it for another day on the blog, thanks for joining us.

We will be back with you early tomorrow morning 😊

Catch The Business on ABC News at 8:44pm AEST, after the late news on ABC News Channel, and any time on ABC iview.

Until tomorrow, take care of yourselves.

LoadingRate cuts off cards in September as CPI lifts: Canstar

Headline inflation has risen to an annual rate of 2.8% in July, up from 1.9% in the previous month, marking the first increase in the monthly dataset since December 2024, according to Canstar.

One of the key drivers was the sharp rise in electricity, up 13.1% for the year, it said.

Even with inflation nudging up, competition in the variable mortgage space continues to push rates lower.

Since the August cash rate cut, 88 lenders have announced variable rate cuts, with the vast majority passing on the full 0.25 percentage points, according to Canstar’s rate tracker.

Canstar.com.au analysis has also shown:

- 4.89% is the new current lowest variable rate

- Almost 30 lenders now offer at least one variable rate under 5.25%

- 5.54% will be the estimated average variable owner-occupier rate for existing borrowers

- 5.8% will be the estimated average variable investor rate for existing borrowers.

Today's market wrap-up

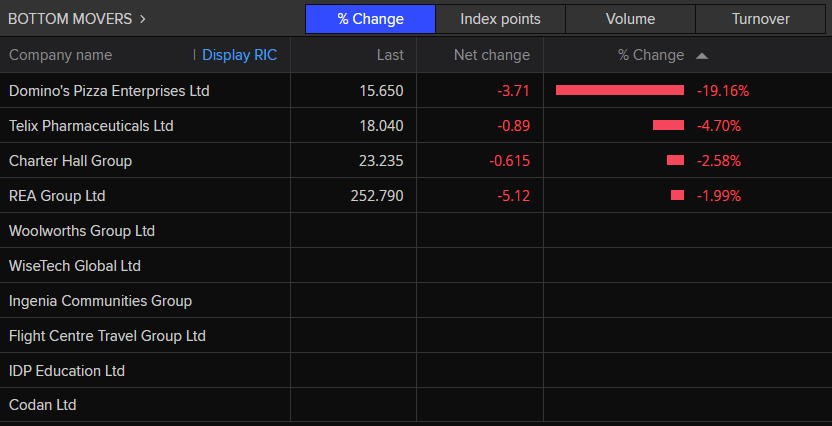

Overall, the ASX200 had 122 stocks gaining, 8 unchanged and 70 stocks in the red.

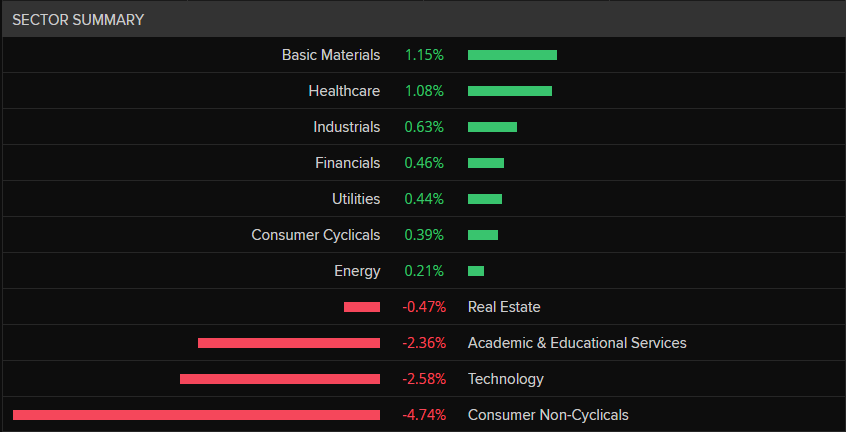

When looking at the sectors, Basic Materials at the top; up 1.15%, followed by Healthcare; up 1.08% and then Industrials; up 0.63%.

Consumer Non-Cyclicals finished at the bottom; down 4.74%, followed by Technology; down 2.58%, and then Academic & Educational Services; down 2.36%.

Looking at individual stocks, here are the best performers:

- Tabcorp Holdings +23.59%

- Siteminder +20.92%

- Lovisa Holdings +12.74%

- Liontown Resources +10.71%

- Worley Ltd +10.55%

And the worst:

- Domino's Pizza -21.54%

- Woolworths -13.58%

- WiseTech Global -11.91%

- Flight Centre Travel -4.25%

- Ingenia Communities Group -3.87%

ASX gains 0.3%

Trading has finished on the ASX for the day, and the ASX200 index has gained 25 points (+0.3%) to close at 8,961 points.

ACF criticises Woolies as it 'appears to' abandon a key sustainability goal

The Australian Conservation Foundation has expressed concern after Woolworths removed beef from its list of primary deforestation-linked commodities in its 2025 Sustainability report.

ACF’s nature and business lead Nathaniel Pelle said the company's move was "extremely worrying".

“All the evidence says beef pasture expansion by a minority of landowners is the number one driver of deforestation in Australia, eclipsing housing construction, mining and infrastructure many times over.

“Australian consumers ought to be able to walk in to a supermarket to pick up a steak and be confident that they are not contributing to the destruction of koalas’ homes.

At Woolworths they can’t be."

Meanwhile, ACF said it welcomed Coles’ commitment to no longer directly source beef linked to deforestation by the end of this year.

China’s coking coal imports fall again in July, putting pressure on prices

China’s coking coal imports fell by 11% per year in July – deteriorating from the 8%/yr decline in June, according to the Commonwealth Bank's research.

Imports decreased by around 8%/yr in the first seven months of the year, the CommBank said.

With China accounting for about 33% of the world’s coking coal imports, the fall in China’s coking coal imports is a key source of downward pressure on coking coal prices.

The research showed that, despite the fall in Chinese coking coal imports, Australia's exports increased 6%/yr from January to July, taking Australia’s share of China’s imports to about 9%.

This share declined meaningfully from 40‑45% in 2018 and 2019 as China found alternative and cheaper coking coal following China’s unofficial ban on Australian in late 2020.

Mongolia and Russia have largely replaced Australia’s share of China’s coking coal imports, which is unlikely to reverse unless a Ukraine-Russia ceasefire increases the appetite for Russian coal outside of India and China, according to the research.

Brett Blundy-backed Lovisa profit jumps thanks to store expansion

Lovisa, owned by billionaire retailer Brett Blundy, has reported that its financial year 2025 revenue rose by 14.2%, to $798.1 million, compared to the previous year.

In its latest financial report, the jewellery brand stated the increasing profit reflected growth in its store network and comparable store sales, which rose by 1.7% for FY24.

Jason Pohl, partner at ECP Asset Management, described Lovisa's result as "an attractive growth story with a global store rollout opportunity".

"A very clean result, margins up, rollout re‑accelerated, and early FY26 comps are ticking higher.

"We see that Lovisa exits FY25 on the front foot, with Europe leading while the US regains momentum."

Mr Pohl also highlighted two key things in Lovisa's report:

- discipline on price/promo and sourcing that kept gross margin at a record;

- a clear step‑up in the cadence of openings in Europe and North America after a slower start to the year.

Meanwhile, he noted that the company kept gross margin at 82% while investing in people, systems, and supply chain, which was "the hallmark of resilience".

Lovisa's share price was $41.62, up 14.3% from $36.41, about 3:25pm AEST.

ASIC warns of fake celebrity scams

ASIC has urged Australians to be on the lookout for fake celebrity finance scams.

So far in 2025, more than 330 investment scam websites have used celebrity images to trick consumers into "investing" their savings, a 25% increase compared to the same period last year, according to the watchdog.

Well-known personalities whose images have appeared on fake websites include billionaires Andrew "Twiggy" Forrest, Gina Rinehart and Anthony Pratt.

According to the National Anti-Scam Centre, Australians lost $945 million to investment scams in 2024, making it the leading cause of financial loss.

The rise of artificial intelligence has enabled scammers to expand their operations at scale rapidly.

ASIC says the following trends have been seen in the last six months:

- fake trading platforms

- cloned websites and professional-looking templates

- fake news articles promoting fraudulent schemes

- "AI trading bot" products promising unachievable returns.

S&P expects Woolies to 'regain market share and repair earnings' by further discounting

As the supermarket giant posted a steep 19.1% slump in underlying profit that saw its shares tank on the ASX, S&P Global Ratings analysts Puchen Wang and Sam Playfair have offered a glimmer of optimism for the BBB-rated company.

"Woolworths Group Ltd has sufficient credit buffers to absorb underperformance in its core Australian supermarket operations," they noted.

"We expect the group's focus on grocery price discounting and cost-saving programs to drive its strategy to regain market share and repair earnings in fiscal 2026."

They also forecast positive news for customers of the major supermarkets who have felt the pain of rampant grocery price inflation, with further discounting and price reductions in the offing.

"Consumers remain focused on value despite gradually easing pressure on household budgets," the analysts observed.

"To retain existing customers and lure back others, we believe Woolworths will continue to invest in grocery pricing, particularly as competition among rivals intensifies."

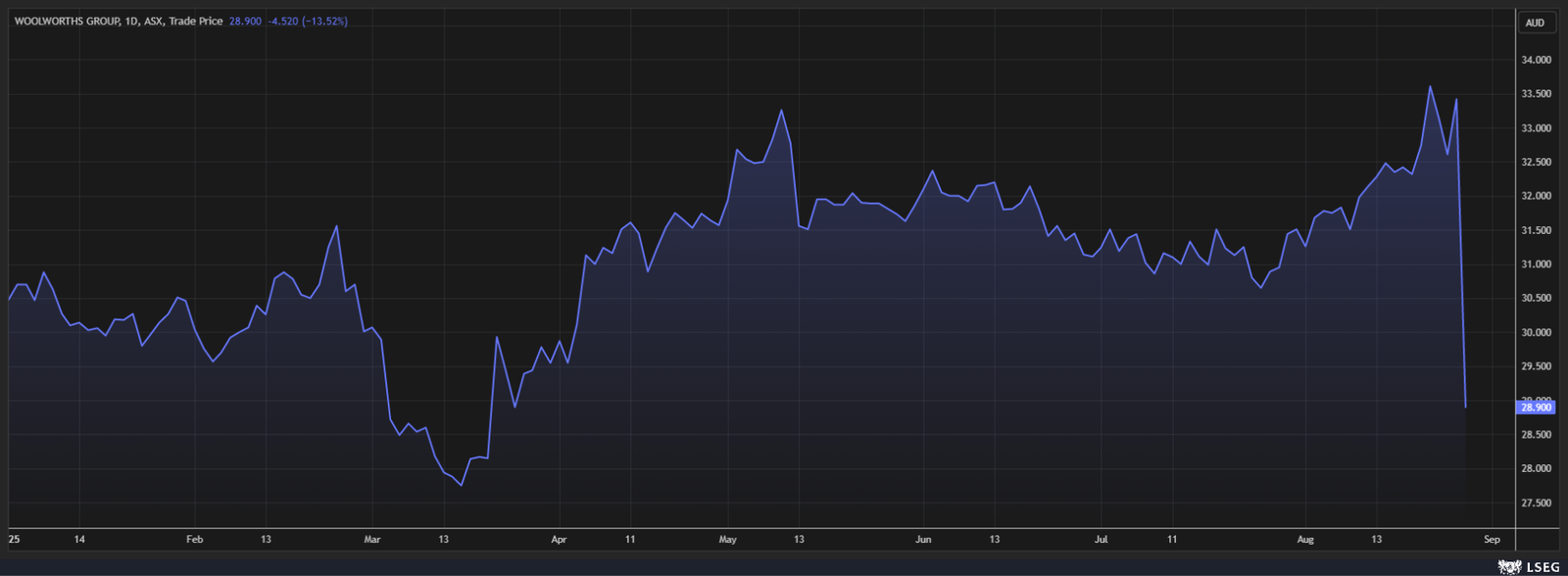

Woolworths shares were down 13.2% to $29.01 about 3pm AEST.

Other than a brief period in March this year, Woolworths shares are trading at their lowest level in more than six years.

Coming up on The Business

We have some more results from some of Australia's biggest company names for you on tonight's show.

Emilia Terzon will be taking a closer look at the price wars in the supermarket sector.

Today's FY25 results from Woolworths surprised many — just take a look at how the share market has reacted.

At the time of writing, the ASX shows the Woolworths price is down more than 13% — that's the steep drop you can see at the end of the graph.

Emilia will be taking a closer look at who's coming out on top of the competition between Woolies, Coles and Aldi.

Flight Centre's FY25 results have also disappointed investors with the share price currently down almost 4%. CEO Graham Turner will be my guest.

And I'll also be talking to the ABC's chief business correspondent Ian Verrender for an important update on Star Entertainment Group's tortured attempts to secure a long-term lifeline.

Watch on ABC News at 8.45pm, after the late news on ABC TV or anytime on ABC iView.

India faces 50pc-plus tariffs from today

Indian exporters are bracing for a sharp decline in US orders after trade talks collapsed and Washington confirmed steep new tariffs on goods from the South Asian nation, escalating tension between the strategic partners.

Goods entering the United States will face an additional 25 per cent tariff from Wednesday, local time (1:31am AEST), taking some levies to 50 per cent.

US President Donald Trump announced the additional tariff in retaliation for New Delhi buying Russian oil, which has become a key funder of its war in Ukraine.

Read more of the Reuters/ABC story below:

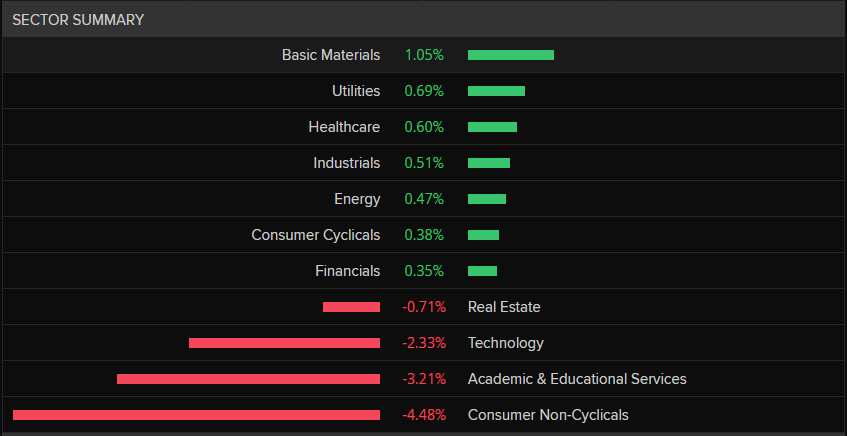

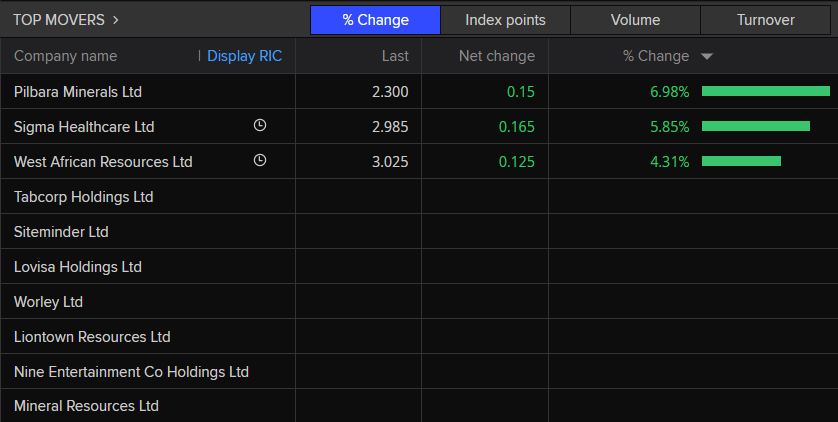

Best and worst performing stocks, so far

The basic materials sector has been the big winner, followed by utilities and healthcare.

Among the best performing individual stocks on the ASX200 today were Pilbara Minerals (up 15 cents, +3.7%, to $2.3), Sigma Healthcare (up 16.5 cents, +5.8%, to $2.98), and West African Resources (up 13 cents, +4.5%, to $3).

Among the worst performing stocks were Domino's Pizza (down $3.71, -19.1%, to $15.65), Telix Pharmaceuticals (down 89 cents, -4.7%, to $18.04), and Charter Hall Group (down 61.5 cents, -2.6%, to $23.235).

'Risk that the RBA is close to the end of its easing phase'

HSBC's chief economist for Australia and New Zealand Paul Bloxham says, while the ABS monthly CPI Indicator is volatile, the scale of the upside surprise should cause some pause for thought about whether inflation will settle at the mid-point of the Reserve Bank's 2-3% target band.

"This provides some evidence that although core inflation has been tracking towards the mid-point of the RBA's target band (trimmed mean was 2.7% y-o-y in Q2), and this has allowed the RBA to cut 75bp [basis points] so far, core inflation may end up stuck in the upper part of the 2-3% target, rather than eventually getting to its mid-point or below," he wrote.

"The mechanism for getting core inflation to fall further is also not clear. After all, the economy is close to full employment, with the unemployment rate broadly steady, surveyed capacity utilisation still above its historical average and the supply-side of the economy still hamstrung by very weak productivity.

"At the same time, growth is in an upswing. Recent figures have shown a pick-up in consumer spending, a lift in consumer confidence and rising housing prices and housing activity. In addition, today's construction work done figures also surprised the market to the upside, rising by 3.0% q-o-q [quarter-on-quarter], versus market expectation of 1.0% q-o-q. These forces should support a solid rise in GDP growth in next week's print — our central case is 0.5% q-o-q.

"Our central case is that the RBA will only be able to cut by a further 50bp in this easing phase (in November 2025 and February 2026), but we see the risks as clearly weighted to less easing than this, rather than more.

"Today's figures increase the risk that the RBA is close to the end of its easing phase. An upside surprise in next week's GDP figures could further increase that risk."

Russia faces fuel shortages and high prices as Ukraine strikes oil refineries

Petrol shortages have been plaguing several regions in Russia, as Ukraine escalates its attacks on the country's oil refineries.

The repeated drone and missile attacks have sent petrol prices in Russia to record highs.

Wholesale prices rose by nearly 10% this month and by nearly 50% since the beginning of the year, according to data from the St Petersburg stock exchange.

Our Europe correspondent Bridget Rollason is reporting from London.

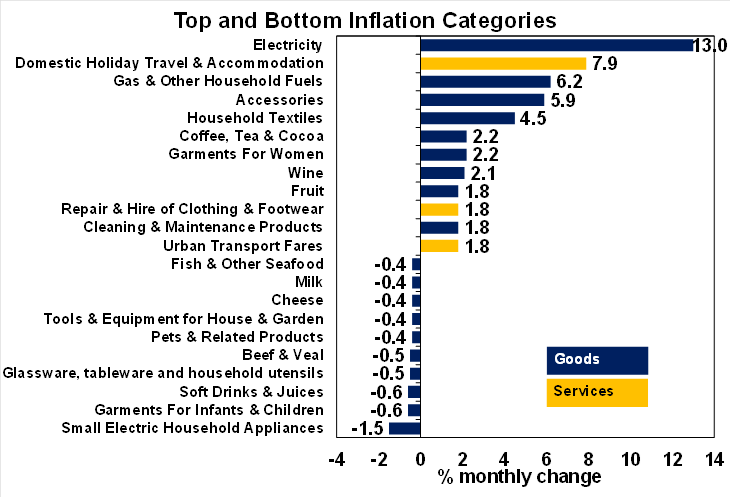

The prices that are rising and falling most

Some interesting analysis on the details of the ABS monthly Consumer Price Index Indicator for July, from AMP economist My Bui.

"The July report only measures about 2/3 of the items in the basket and features many goods rather than services items, which are inherently a bit more volatile and harder to forecast because they are not as 'sticky' as dining out, hairdressing, household services, or insurance," she wrote.

"But today's report clearly shows that the downtrend in goods inflation over the past two years has run out and the next leg in inflation would depend on services momentum (which is still in a very gradual downtrend)."

Flight Centre shares slump on 'ongoing turbulence'

Flight Centre's shares have fallen as much as 6% during the session — the stock is currently 3.5% lower, meaning shares have lost a quarter of their value since January.

The travel company's statutory net profit declined nearly 22%, $109 million.

Underlying profit before tax dropped nearly 10%.

The company said its declining earnings were significantly impacted by the escalating tensions in the Middle East and the ongoing global downturn in bookings to the US.

Managing director Graham Turner said "some ongoing turbulence" would be expected in early 2026, but the travel sector was also starting to see "signs of stabilisation".

RBC Capital Markets analyst Wei-Weng Chen said Flight Centre's result was "largely in line with expectations".

Mr Chen said the near-term outlook was on the weaker side, given management was expecting profits for the start of the current financial year to be "fairly flat", compared to this time a year ago.

He noted that if analysts left their expectations for the second half of FY26 unchanged, a flat first half translated to a 2% downgrade to underlying profit for the full year.

Wisetech shares plunge on disappointing profit result

Wisetech shares have dropped sharply on disappointing profit results.

The logistics tech company reported statutory net profit after tax of $200.7 million for the financial year just ended, missing consensus estimates of $212.6 million, according to Reuters.

Revenue of $778.7 million came in 2.3% lower than typical analyst expectations.

The firm declared a final dividend of 7.7 cents per share, up from 6.2 cents a year ago.

Reuters reports that shares of the firm dropped as much as 17.8% to $95.21, before bouncing back somewhat.

E&P tech analyst Paul Mason says Wisetech's analyst briefing call "was better than the headlines", but left some outlook questions unanswered.

"In terms of how it trades from here, it has clearly had a good rally during the call, feels to me like -10% is about right today (vs current trading negative mid-high single digits) based on the multiple + 3% or so FY26 guidance miss vs expectations," he wrote.

"Would expect consensus downgrades to both FY26 and FY27 overnight."

At the moment (12:53pm AEST), Wisetech shares are down 9.5% to $104.76, so Mason looks pretty close to the mark according to the market.

Market snapshot

- ASX 200: +0.3% to 8,960 points

- Australian dollar: flat at 64.93 US cents

- Nikkei 225: +0.3% to 42,529 points

- Wall Street: Dow Jones (+0.3%), S&P 500 (+0.4%), Nasdaq (+0.4%)

- Europe: FTSE (-0.6%)

- Spot gold: flat at $US3,392/ounce

- Brent crude: +0.15% to $US67.32/barrel

- Iron ore: +0.1% to $US101.75/tonne

- Bitcoin: -0.27% to $US111,387

Prices current around 1:10pm AEST

Live updates from the major ASX indices:

Where there's a will there's a way

Why only two options for superannuation inheritance and to one nominated person? Maybe that is why they do not nominate either options. Most people have wills. Superannuation is an asset so why can't it be included in the will?

- J

Hi J,

Actually, according to legal experts, a valid will is one of the most effective ways to transfer your superannuation to the person/people/organisations you want it to go to.

You can find more information in Nassim Khadem's explainer — you just need to read a fair way down to get to the section about wills.